Get ready for Making

Tax Digital in seconds

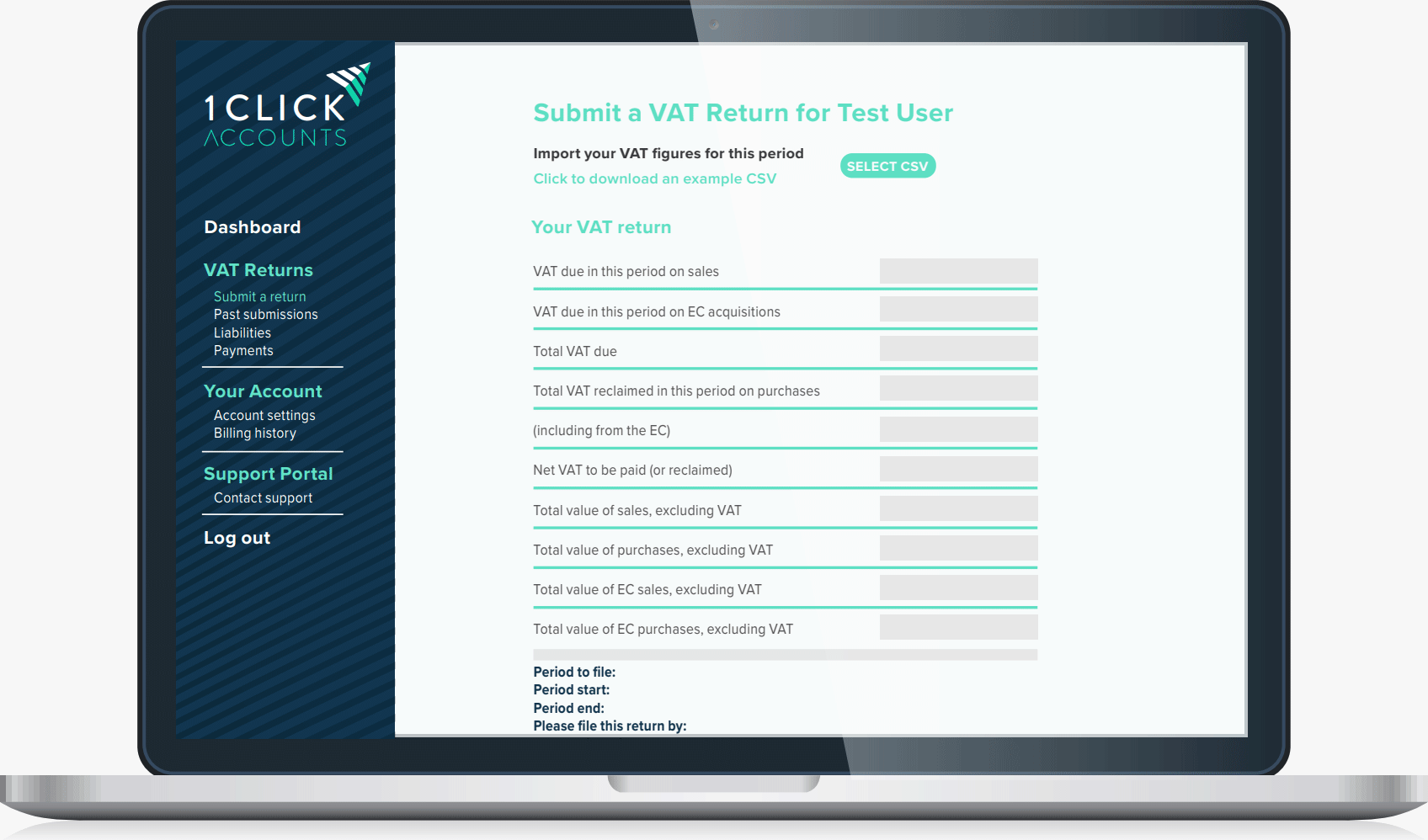

1 Click Accounts simply tacks onto your existing software.

There’s nothing to install, no complex user interface, just a simple VAT return form that lets you submit your VAT returns with Making Tax Digital.

And that’s it. Simple.

Built for accountants and businesses that already have bookkeeping software, you can keep using your old software – and just submit your figures.

> 1 Click Accounts works with any bookkeeping software, even your own Excel spreadsheets!

Ready for MTD

File VAT returns with making

tax digital – in just seconds

No need to migrate

Keep using your old software;

just file VAT returns with us

Secure submissions

Your VAT returns are encrypted

with military-grade technology

Keep costs minimal

We offer a simple service – and charge almost nothing.

Takes moments to submit VAT Return. I recommend this software to my friends!

– Elena O.

Super efficient easy to use service and the cheapest I have found! Perfect in every way!

– Lynchford

So glad I used 1 click accounts for submitting

my vat returns, it is so easiest to use!

– Karen Grabham

Everything you need to get

ready for Making Tax Digital

Are you looking for a way to keep your existing software, and just submit VAT returns with Making Tax Digital?

If so, you need 1 Click Accounts.

You’ll be able to keep your old software, and simply submit VAT returns using 1 Click Accounts.

At the end of each VAT period, simply log into 1 Click Accounts, import your figures, and click submit.

We’ll handle the Making Tax Digital side of things, so you can keep using your old software. You won’t need to migrate to new software, learn a new platform, or move your clients to a new system.

How to Submit a VAT Return in 30 Seconds or Less

MTD Reporting

is awesome

The new digital tax initiative at HMRC will mean you can submit VAT returns, check past submissions, view a history of past payments, and outstanding liabilities – all from one single location.

Not only that, but you’ll find charts of past submissions, along with breakdowns of EU / UK sales and purchases – which you can download and use in your own client reports.

We’re here to help you look great. And if there’s any way we can further enhance the reporting side of things, just let us know!

Making Tax Digital Software at a ridiculously low cost

1 Click Accounts costs next-to-nothing.

It’s such simple software that our costs are very, very low. And those savings are passed entirely on to you.

The software costs just £19.95 per company per year, and this is further discounted if you are an agent [click here for details]

This price includes all your VAT returns for the full year.

No extra fees, no hidden surcharge. Just low cost software that works.

I have a question!

Does this software work with Sage / my commercial bookkeeping software?

Yes… 1 Click Accounts works well with most bookkeeping software, including Sage 50, Sage 200, Sage Instant, and most other Sage packages, as well as Money, Quickbooks, and other third party bookkeeping software.

You do not usually need to upgrade your version of Sage, or change your accounting software.

All you’ll need is an export of your VAT Return in CSV format. 1 Click Accounts is already compatible with Sage VAT Returns, and will allow you to submit them to HMRC, with no additional work or changes.

If you have a question about a specific file format, please register for an account, and contact support to confirm compatibility with your specific software.

Does this work with Excel / Apple Numbers / Google Sheets / my own spreadsheets?

Yes, 1 Click Accounts works with all bookkeeping software, including your own spreadsheets.

If you record your VAT transactions in a spreadsheet, all you’ll need to do is digitally link your VAT Return to your transaction history.

If you need help with this, once you’ve registered, please see the video tutorials and example spreadsheets in the How To : Tutorials section

I still do our books the old fashioned way with pen & paper. Can we use your system?

With Making Tax Digital, one requirement is that you will need to keep a digital record of your transactions. It is no longer acceptable to use paper records to calculate your VAT Return.

As such you will need bookkeeping software of some kind, in order to keep your records in the required format.

If you need bookkeeping software, try our sister company for a cheap, user-friendly solution at https://10minuteaccounts.com

Can I have a trial of your software?

Yes. In fact, you can sign up absolutely free, and try all features of the software, with no need to pay at all.

You can test out the integration, and try importing a CSV file with your figures, and test connecting the software to HMRC.

You’ll only need to pay once you’ve committed to using the software, and are ready to submit your first VAT Return with Making Tax Digital.

Is your software compatible with an Apple Mac / Windows XP / Excel 97?

1 Click Accounts is Cloud Software. This means it runs in your browser. There’s nothing to download, and it’ll work with your existing computer, with no changes neccessary.

1 Click Accounts is compatible with all internet-capable computers, including Apple Macs.

How much does this software cost?

1 Click Accounts is exceptionally low cost software, and costs almost nothing.

For current pricing, please see: Pricing

Will this software keep working after April 2020?

Yes our software is fully compliant with the Digital Link requirement from April 2020.

Until April 2020, there is a ‘soft-landing’ where you can manually copy figures from your software into the VAT Return.

After April 2020, you will need to ensure your VAT Return is generated by your software.

1 Click Accounts is compatible with both scenarios, and you will be able to continue using it to submit returns after April 2020.

Do you support the Flat Rate / Margin / Global Accounting / Cash VAT scheme?

Yes, 1 Click Accounts supports all VAT schemes.

You will normally use your own software or spreadsheets to calculate the 9-box VAT return, and import this for submission to HMRC.

Our software does not perform any calculations on your behalf. It simply enables you to import and submit a 9-box VAT return, regardless of which VAT scheme you are using.

I manage several companies. Can I submit all VAT Returns from one login?

Can I file a return as a sole-trader? Or just as an incorporated?

1 Click Accounts is suitable for all company types.

The software simply allows you to submit a VAT Return with Making Tax Digital. It makes no distinction between submitting for a sole-trader or submitting for a limited company.

All you need is a VAT Number, and you’ll be able to submit returns with 1 Click Accounts.

I am an accountant. Can I file for several companies at once?

Yes. Please ensure you set your account as an Agent / Accountant during the initial setup.

You can then add as many companies as you like, and file VAT Returns individually for each one.

As an accountant, you’ll receive a bulk discount on pricing – please see the pricing page for more details

I have another question?

If you have a question not listed above, you might find that your question is answered by registering for an account. This is completely free to do, and you can then explore the software and see how it works.

If you still would like to ask a question before registering, please click here to access the Contact Form.

Start your free, no obligation trial of the software

and see how it works for yourself

No Credit Card Required to open an account.

By registering for this service, you agree to our

terms & conditions and privacy policy